GUEST SUBMISSION: If you pay property tax in Ontario, you have likely heard about the ongoing delay of the province-wide general reassessment.

You might think that you are benefitting from this delay, especially if the existing assessment of your property is below its current market value. You might also be worried that a reassessment will drive your property taxes higher.

You might be wrong.

A reassessment is desperately needed to restore fairness, transparency and predictability to Ontario’s property tax system. Ontario has fallen behind the rest of Canada and much of the U.S. Instead of updating property values, municipalities have been forced to increase tax rates to raise required revenue.

Furthermore, continued uncertainty over the timing of the next update is disrupting municipal planning and fuelling growing inequities across the province.

Here’s why Ontario taxpayers should not only want a reassessment but demand it.

Reassessment doesn’t mean higher taxes

One of the biggest misconceptions is that a reassessment automatically results in higher property tax bills. It does not.

In fact, municipalities are required to adjust their tax rates to ensure reassessment does not increase the total revenue collected. When overall assessed values rise, tax rates must decrease to offset the increase in property values.

Here’s how it works: municipalities calculate how much money they need to operate - for services like roads, libraries, fire protection and parks - and then divide that amount among all property owners based on the relative value of their properties.

As Connie Mesih, director of revenue and material management for the City of Mississauga, emphasized during Ontario’s last reassessment in 2016: “An increase in assessment does not necessarily mean an increase in property taxes . . . Tax rates are adjusted to offset assessment value changes and to ensure the City does not receive a windfall gain as a result of an increase in assessment.”

So even if your property’s assessed value increases, your tax bill will only rise if its value has increased more than the average in your municipality and tax class.

For example, if the value of your home has risen at an average rate, your taxes will likely stay the same. However, if the value has increased by less than average, your taxes could decrease.

Ontario law currently requires assessment increases due to revaluation be phased in over four years. This gradual approach softens the blow resulting from any major increases in value. Decreases, on the other hand, are implemented right away, providing immediate relief to taxpayers.

Reassessment restores fairness

At its core, reassessment is about fairness - ensuring that each property’s share of taxes is proportionate to its current value, not the value from almost a decade ago.

Ontario’s property taxes continue to be based on 2016 values. Since then, real estate markets have shifted dramatically and unevenly across the province.

This creates serious distortions.

In a recent presentation, Ontario’s Municipal Property Assessment Corporation (MPAC) reported the total value of commercial properties in Ontario increased by more than 108 per cent between 2016 and 2024.

At the same time, enclosed shopping malls in some smaller markets have actually declined in value. A number of properties that were purchased between 2013 and 2015 changed hands again between 2019 and 2024, at prices up to 50 per cent less than was paid previously. These properties and their tenants have been paying taxes based on values nearly double their current worth — some for several years.

According to data provided by the Ontario Real Estate Association (OREA), the average price of a home in Ontario has grown by more than 62 per cent between 2016 and 2023. Within each municipality, however, the values of some homes have increased more than others.

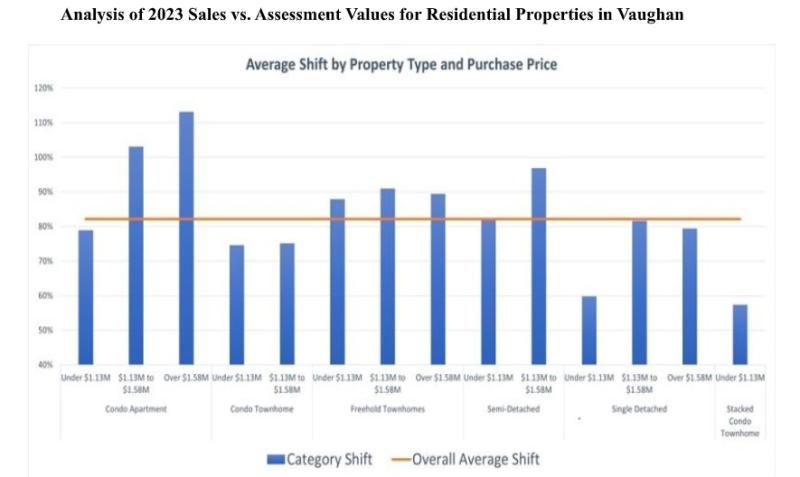

In a RENX report published in January 2025, Ryan presented a comparison of 2023 sale prices to the 2016 base year assessments for homes in Vaughan, Ont. This analysis indicated that condo townhomes, condo apartments, and single detached properties valued at less than $1.13 million had increased by less than the average residential property increase.

These property owners are paying more than their fair share of taxes and will continue to do so until the province conducts a reassessment. Meanwhile, as municipalities raise tax rates to support increasing costs (for example, Vaughan increased its tax rate three per cent this year, while rates in Toronto and Mississauga went up by 6.9 per cent and 9.2 per cent respectively), the unfair burden on over-valued properties is magnified.

As economist Harry Kitchen and colleagues have explained: when one property pays too little tax, others must overpay to make up the difference. A general reassessment helps ensure everyone pays their fair share.

Imagine if income tax payments were frozen for a decade. Retirees would be paying taxes based on their peak earnings, while senior executives would pay taxes based on the junior years of their career.

The longer Ontario delays reassessment, the further these inequities deepen. Municipal finance experts have warned that unfairness compounds year after year.

Taxpayers whose properties have increased in value by less than the average may have been paying more than their fair share of taxes for five years, with no timeline for relief in sight — and no retroactive corrections or refunds on the way to offset the overpayments.

Reassessment supports better services and smarter planning

Updated property assessments do more than just restore fairness. They help communities and businesses plan future investments.

Property taxes fund many of the local services that residents and businesses rely on every day, including:

Snow clearing, and garbage collection;

- Police and fire services;

- Libraries, recreation centres, and parks;

- Public transit and infrastructure maintenance; and

- Social housing and community supports.

Municipalities rely on up-to-date assessments to budget responsibly and plan effectively for future growth. When assessments are disconnected from reality - and when there’s no clear schedule for correction - municipalities risk underfunding key services or misallocating resources.

Accurate data also helps protect the financial stability of cities. It reduces the risk of surprises and helps avoid funding shortfalls that could jeopardize essential services.

For businesses, predictability matters. Companies need to know how taxes will affect their operating costs and rents. Developers need reliable estimates of tax burdens during the holding, construction and occupancy phases. Without that certainty, projects may be delayed or cancelled, including urgently needed housing developments.

And for homeowners, reassessment provides peace of mind that their taxes are grounded in real-world values — not outdated and arbitrary figures.

Ontario reassessment long overdue

Across Canada, most provinces update property assessments annually - other than Ontario, only Saskatchewan’s assessment cycle lasts longer than two years. Regular updates make for smaller, more predictable changes - and fewer political and financial shocks.

Ontario’s last reassessment occurred in 2017, based on values from January 1, 2016. By law, new assessments were scheduled for 2021–2024, and again for 2025–2028. However, the government suspended the process during the COVID-19 pandemic and has continued the freeze every year since.

To date, the province has not provided any details on the timing nor basis of the next reassessment. As a result, taxpayers in 2025 are still being taxed on nine-year-old values — an unprecedented delay in modern Ontario history.

We’ve seen the dangers of such inaction before. In 1998, when Ontario launched its first province-wide reassessment, some municipalities were using assessments that were up to 40 years old. The resulting shifts in tax liability were so severe the province had to impose caps on increases and claw-backs on reductions to manage the transition.

The lesson is clear: frequent reassessments are better. They maintain trust, ensure stability and make the system fairer for everyone.

A smarter, fairer system for everyone

Here’s the bottom line: a reassessment doesn’t raise property taxes - it just redistributes them based on today’s property values.

It corrects imbalances, enhances fairness, improves planning, and gives municipalities and businesses the accurate information they need to serve their communities.

Taxpayers should want a general reassessment. Because a system built on nine-year-old data isn’t just outdated - it costs taxpayers money and erodes trust.

Embracing a reassessment does not mean signing up for higher tax bills. It means:

- Relief for those who have been overpaying;

- Assessments that reflect current market values;

- Better planning and budgeting for municipalities and businesses; and

- A stronger, more transparent property tax system.

Reassessment is not something to fear. It’s something taxpayers in Ontario have waited far too long for - and something that will make the province’s property tax system better for everyone.

This article was co-authored by Sandi Prendergast, director research, property tax, at Ryan.