For Canadians who dream of owning a home but need guidance in overcoming the hurdles, Montreal-based Application Homie Inc. has developed an app-based coaching service it believes will help aspiring buyers cross the finish line.

Named Homie, the app presents first-time homebuyers with a concept of the type of property they can currently afford, then a step-by-step plan toward actually buying the home they desire.

“It is a platform that scales the type of advice and ongoing mortgage coaching that you wish you could get from the banks’ best mortgage advisor or broker,” Homie’s co-founder and CEO Andrew Peker said in an interview with RENX Homes.

Homie can also benefit mortgage originators by raising their conversion rates, he added.

Operating Canada-wide, Homie has partnered with Toronto-based online mortgage brokerage Homewise, which is now funnelling potential homebuyers toward its service. Homie plans to announce more partners soon, Peker said.

Homie for potential homebuyers readying for the big step

Application Homie was founded in January by a team with backgrounds in mortgage lending and brokerage. Peker was most recently the head of product, mortgages and partnerships at Calgary-based Neo Financial, and before that a co-founder of Quebec-based mortgage lender Wiseday.

The co-founders of Application Homie are aware of “some of the pain and challenges that they face when it comes to nurturing or tending to folks that are not quite ready yet” for a mortgage, Peker said.

At the mortgage originators where he worked, he saw a fixation on hitting monthly revenue targets, which involved companies building filters to identify who is most, and least ready, to finalize a mortgage. The best mortgage advisors focus on the clients with the most potential to close, which Peker believes causes companies to misunderstand what many consumers need and to ignore a wide potential customer base.

He witnessed Canadians with solid financials and credit scores, but also good reasons to delay homeownership, such as being engaged to be married.

“There’s no one there to really tell them all these really complicated nuances around what it means to buy a home,” he said, because of the emphasis on getting the best prospects into mortgages. However, people in these situations are valuable potential clients in coming months and/or years.

To bridge these gaps, Homie is geared for the “folks who are getting ready to buy that aren’t ready to make a move just yet,” and are receptive to coaching. Another target audience is salaried workers with little time in their days to reflect on their finances.

How Homie works

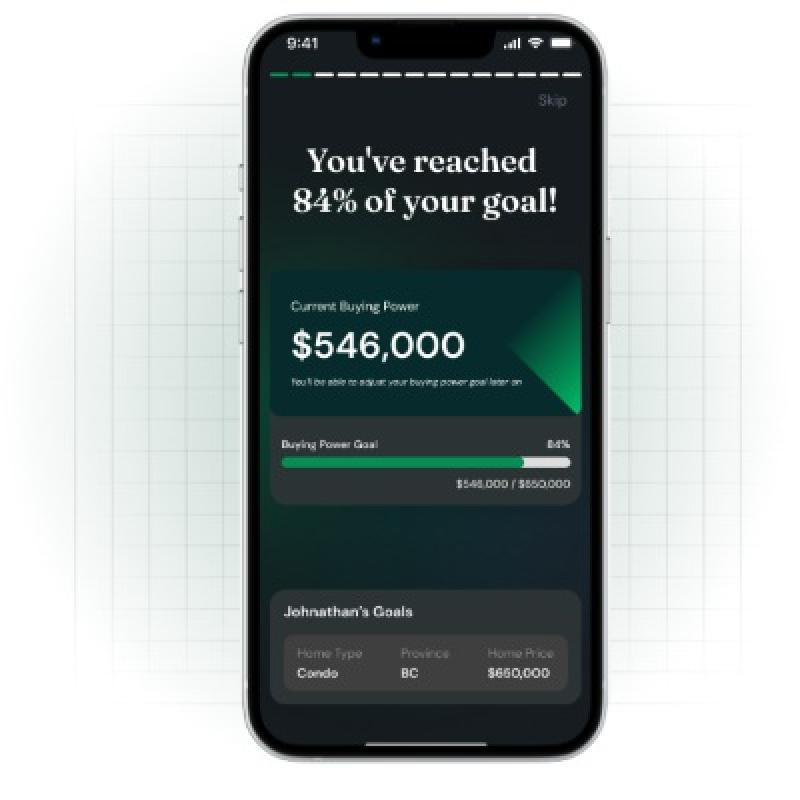

The app starts by asking the user questions to figure out the home they can afford today if applying for a mortgage from a Big Five lender. The answers will shape the user’s goals, such as what kind of home they wish to own.

To better understand the user’s financial situation, Homie will take information directly from sources such as Equifax for credit scores.

With the findings, Homie will analyze the user’s buying power and compare it to their goal. Identifying any shortcomings, Homie will prescribe actions to reach that target, such as improving one’s credit score, changing monthly and daily spending habits, and whether they should consider a co-applicant.

Every week, the data on Homie is refreshed to account for changes in the user’s buying power and progress on their goal, or shifting market conditions.

Unlike advisory work done by people, Homie is able to track the client’s status at all hours and develop a comprehensive view of their finances, Peker said. The app can draw a more accurate assessment of the user by looking at information from the source, rather than relying on self-reporting where errors and false expectations can creep in, he continued.

Homie’s app covers Canada, focusing on Ontario, Alberta and British Columbia. The company’s home province of Quebec is not a priority yet because it is a “super nuanced market,” according to Peker. But Homie will be serving Quebec soon, he added.

The app is available only on iOS today, but will be open to Android phones in the near future. Homie is free for its users.

Funneling users back to mortgage originators

Through Homewise, Homie will be introduced to applicants who are not yet ready for a mortgage. Once they are deemed prepared to take on the home loan, they will be referred back to Homewise, which is expected to improve Homewise’s conversion rate, Peker said.

Homewise is Application Homie’s first partner, a relationship it formed to better prepare itself before broadening its reach.

Application Homie is also focused on including more features with its app. One coming feature Peker previewed is advising users on what changes to interest rates mean for their buying power.