Younger Canadians are feeling significantly more pressure to own a home than the generations that preceded them.

According to a recent survey by digital real estate platform Wahi, the pressure millennials and Gen Z are facing, in many cases, rivals expectations around marriage and parenthood.

The 2025 Homebuying Pressure Point Survey, which polled members of the Angus Reid Forum, reveals a striking generational divide. More than half of millennials (54 per cent) say they’ve felt pressure to own a home at some point, while 41 per cent of Gen Z respondents report the same. Those figures stand well above the national average of 34 per cent. By contrast, only 30 per cent of Gen Xers and 13 per cent of baby boomers say they’ve experienced that same sense of pressure. (Column continues below the graphic)

These findings are from a survey conducted by Wahi June 17-19, 2025, among a representative sample of 1,500 online adult Canadians who are members of the Angus Reid Forum. The survey was conducted in English and French. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 2.53 percentage points, 19 times out of 20. (Courtesy Wahi Data Inc. Brokerage / Datawrapper

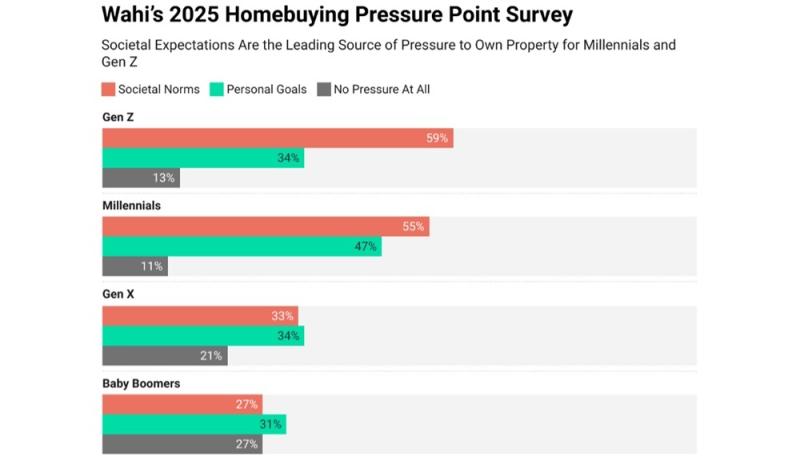

When asked where this pressure comes from, younger Canadians were far more likely to point to societal expectations than to personal goals.

For 59 per cent of Gen Z and 55 per cent of millennials, the driving force behind their homeownership ambitions is the belief that owning property is simply what you’re “supposed” to do. Older generations tell a different story: only one-third of Gen Xers and just over a quarter of boomers say cultural norms have influenced them in this way.

In fact, older respondents were also much more likely to feel no pressure at all: 27 per cent of boomers and 21 per cent of Gen Xers, compared with just 13 per cent of Gen Z and 11 per cent of millennials.

The survey also uncovers a connection between homeownership and other major life milestones.

Among Gen Z, the pressure to buy a home is a close match to the pressure to get married or have children, with all three hovering around 43 per cent. Millennials report a similar pattern: 54 per cent say they feel pressure to own a home, compared to 53 per cent who feel pressure to have children, while marriage comes in slightly lower at 43 per cent.

The role played by geography

Geography plays a significant role in shaping these attitudes.

In provinces like Quebec and those in Atlantic Canada, where renting is more common (particularly in Quebec) and housing remains relatively affordable, pressure levels are lower at 26 per cent and 29 per cent, respectively. By contrast, in Alberta, where rapid population growth and shifting affordability dynamics have made the market increasingly competitive, 41 per cent of respondents report feeling homeownership stress. British Columbia, home to some of Canada’s most expensive real estate, follows closely at 39 per cent.

These differences in pressure levels echo the actual homeownership rates among the generations. Not surprisingly, 81 per cent of baby boomers own property, along with 74 per cent of Gen Xers. Millennials lag behind at 61 per cent and Gen Z is far lower still, with only 21 per cent currently owning a home. More than half of non-owners say they’re unhappy with their current situation, and half of all Canadians believe renting carries a stigma. Perhaps most tellingly, 62 per cent underestimate the national homeownership rate, assuming it to be below 50 per cent.

For young people navigating the decision of whether to buy a home, the good news is there are digital real estate platforms that provide transparent information and insights to help homebuyers make smarter decisions. These platforms not only help people find homes, they also guide them toward decisions grounded in financial and emotional preparedness, rather than in the weight of cultural norms.

Digital real estate platforms offer transparent market data — including sold prices, price changes and real days on market — as well as home value estimate tools and affordability calculators.

For digital-native generations like millennials and Gen Z, these resources align with their comfort in managing major life choices through online platforms.

As Canadian home values have increased over the decades, younger generations are feeling increased pressure as rising home prices push affordability further out of reach. These younger Canadians should take their time, do their research, harness the technology and online tools available, and buy based on personal readiness — not pressure.